When it comes to finances, time is your most valuable resource. The sooner you start the better. Maybe you have finally said, “enough is enough” and you are ready to do something about it. This guide will help you to get started off on the right foot.

Step 1: Write your eulogy. This is one of my favorite exercises from Stephen Covey. The reason is that it helps us to put in perspective what is truly important. You do not want to wake up one day and realize that you spent your precious time chasing the wrong things. Your financial goals should be based on what you truly value and not what you just want. What we want is often times in conflict with what we value. Use the video below you help you think through it. This version is based on your 80th birthday, but the premise is the same.

Step 2: Gather all of your financial facts in one place. This is where technology can really help. Wise Pace has a great platform for our clients to gather all of their information into one place along with fantastic budgeting tools. If you are not a client, don’t worry because there are some great free tools out there such as Mint. This is very important for multiple reasons. One of the biggest reasons is highlighted by psychologist Dr. Daniel Kahneman who also won the Nobel Prize in Economics for this work. Yes. He is that smart. His research highlights how our brains like to operate 95% of the time in automatic mode and the reason is that our thinking mode takes so much effort. You have to do things to help your brain out when not in automatic mode. Any time you are trying to make a change, it will take lots of effort. Help your brain by having all the information in one place to make informed decisions.

Step 3: Find surprising facts about yourself. Dr. Daniel Kahneman’s says “we are more likely to learn something by surprises in our own behavior than by hearing surprising facts about people in general”. Basically, you need to find surprises that don’t line up with what you wrote about in your eulogy and then work towards changing them. Financially speaking this is where the budgeting tools come into play. You can see what you are spending in each category and there is something in there that will be shocking. If you do not have a facial expression like the picture of the women below, then you need to repeat the process until you do.

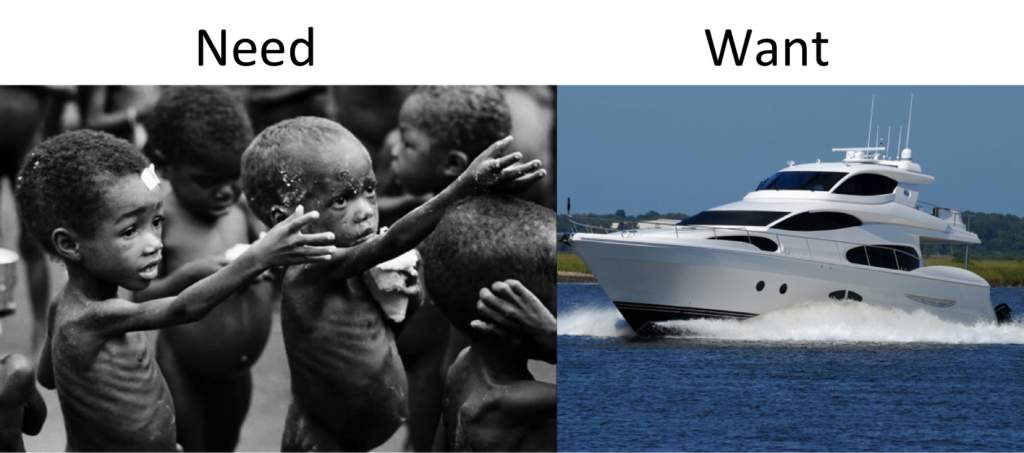

Step 4: Remove the clutter. Where to start can become incredibly overwhelming very quickly. This is why it is important to establish small wins. It is impossible to eat an extra large pizza in one bite. But it is possible one bite at a time. The same is true with your finances. Pick one thing to remove and knock it out of the park. Then add something else and knock it out of the park. As you get stronger, you can then add more things to remove. The goal is to not take on some much at once that you give up or guilt starts to rear its ugly head. You must find a pace that is sustainable for you. Two steps forward and one step back is progress and that is a huge win. When you struggle to decide if something can be removed, run it through the filter of your eulogy. If you still are stuck, use the image below to highlight if it is a need or a want. Wants are great but they might need to be told no for now. The key is, for now, you can always add it later when your goals are being attained.

Step 5: Monitor monthly and make necessary changes. This step is where the rubber meets the road and disciple is introduced. We often times will do a great job of figuring out a fantastic plan but fail to do it long term. Research suggests that it takes 66 days to form a new habit. Said another way, retrain our automatic thinking. But once the retraining has happened we go into a new coast mode that is actually helping us to accomplish our goals. Sticking with your plan for 66 days is vital for success. You have to set up a system that forces you to monitor and make changes. You could set calendar reminders, find someone you trust to hold you accountable or reach out to a financial professional. Whatever you chose make sure it is a system that sets you up for success as opposed to tearing you down. If you know you won’t be able to do it without someone holding you accountable, then don’t pick a system that does not involve someone else.

Everyone has the ability to make a change, it just comes down to if the will to change is stronger than the one not wanting to change. Do you know who or what controls your financial future? Click the button below to gain some insight from this free assessment.