Budgeting is the most important thing that you can do to maximize achieving your goals. With that said, this is not an article about budgeting. Below we will cover some simple steps that you can take to save and not downgrade your standard of living. A little change can be annoying but this will allow you to keep the core elements and still have the ability to save hundreds per month. I am going to cover some average costs and also use some of my personal costs.

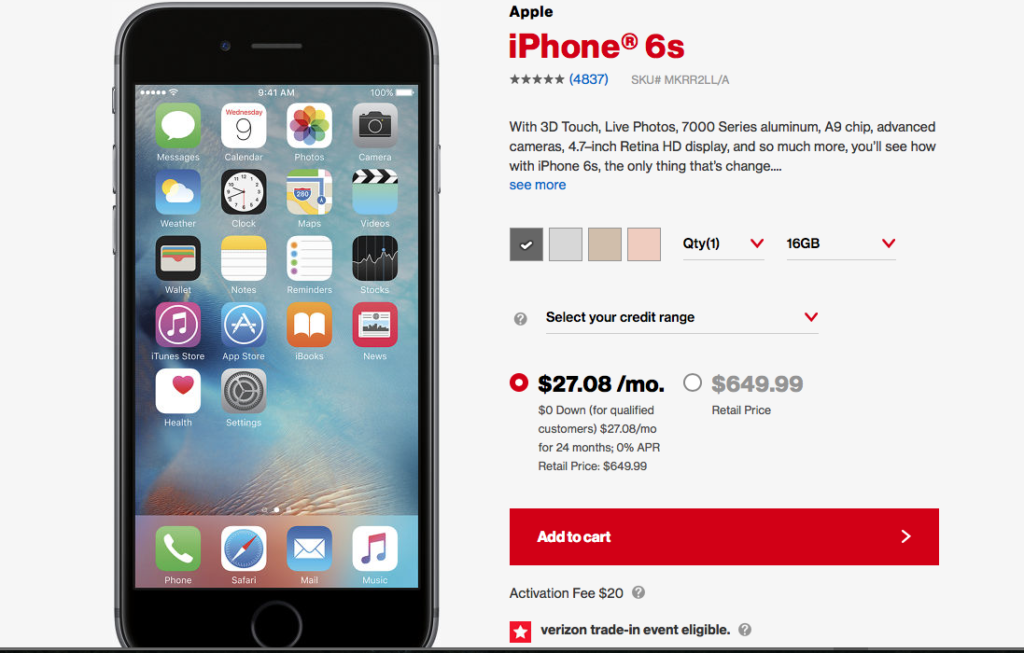

- Switch to Pre-Pay. Smartphones are great but the monthly bills are horrid. Especially since the monthly battle of overages always seems to creep into the bill. I have two big tips which are to pay the phone outright and do not sign a contract. The reason I say to buy the phone outright is because you are not saving anything. Verizon’s current advertisement for an iPhone 6s is zero down, pay $27.08/month for 24 months, and zero percent APR. See picture below. Does it look like a deal? Nope, it’s the exact same price as the full retail option but it comes with a contract. Why do you think cell phone companies are willing to let you walk out the door with a brand new phone by paying only an initial payment of $27.08? The reason is because the value is in the contract. They get you locked in generally for two years and charge an average of $100 per month of revenue that equals $1,200 per year. There are many ways to switch to pre-pay. I stayed with Verizon but switched to pre-pay. We will use my numbers for this example. My monthly cell phone bill was $120 but it is now $45 per month with unlimited talk, text, and 2GB of data. The best part is that I never go over because it is prepaid. If you run low on data they will send you a text notification. You can then decide to purchase more data which is relatively cheap. What you don’t use rolls over for the next 90 days. Total savings per month for me is $75.00. Additionally, I always buy the model just below the newest. The phones are pretty much the same, except one or two minor features. It is worth an additional $100 in savings.

- Cut the cable cord. For most, including myself, this sounds scary. In reality, it equals big savings. The average cable bill runs $99 per month. I don’t know about you but I cannot watch that much TV to make it worth the cost especially with what I am about to tell you. All cable affiliate stations have their own website with free episodes. This is a built-in on-demand/DVR. Yes, they only have about 3 to 5 current episodes of the current season before they fall off the site and you do have to watch commercials, but it’s free! Have an Apple TV? Great, throw the shows up on Apple AirPlay to watch on your big screen TV. If you are an avid Walking Dead fan or love ESPN, you can sign up for Sling TV for $19.99 a month. Check out their site to see the many channels that this price includes. If you prepay now for three months they will send you a free Roku. It is worth it if you plan to use their service but do not do it if you will not use the service. Hulu will give you the ability to see most, if not all, of the shows that you will miss by not having cable. Netflix is also a great alternative. The cost for Hulu is $7.99 with ads, and Netflix cost $9.99 ad-free. Lastly, you can purchase a digital HD antenna to watch the cable affiliate stations for free. What my wife and I do is the following. We signed up for Sling TV (mainly for The Walking Dead but it will help with football season), and already had Hulu. Our entertainment costs with cable and Hulu was $124.99 per month. The new monthly entertainment cost is $27.98 including Hulu. This equals savings of $97 per month.

- Buy generic. Many people already know that generic prescriptions alone will save you tons of money and be just as effective as brand names. Many, including myself, generally buy brand names at retail stores and grocery stores. Brand names do have a value especially when you are talking about big ticket items like cars, sofas, and beds. They start to lose their value in reference to price which makes the grocery store a great place to save. Many generic foods are really just the name brands but packaged as a store brand. This means the quality is usually the same. Consumer Reports did a study on the savings by buying generic brand names. They found that a shopper would save on average 30%. That equals $120 per month in savings if you are currently spending $400 per month.

The total savings that you could experience by using these tips is $254 per month based on the average bills listed in this article. This would equate to $3,048 annually. If you invested your annual savings every year earning an average of 4% for 30 years, it could grow to $176,000 during that timeframe. You could also use the annual savings to pay off your home mortgage and debts saving you thousands. No mortgage + no debts + $3,048 annual savings = massive potential for your future.