Like myself, you have probably never wondered if you were going broke. Maybe you pay all of your bills at the end of the month in a timely manner and there really is not a reason to suspect that something is wrong. The scary thing is, it will creep up and take hold without even knowing it happened. Ever feel like you are living paycheck to paycheck? You might be going broke. So how do you figure that out? For simplicity sake lets define broke. Webster's dictionary defines it as not having any money. Many of us, if we think about it, will realize that we say this once or twice a month before our paycheck arrives. If this is true for you then there is a good chance that you are going broke but let's elaborate on this to show its subtleties.

In order to analyze if you are going broke, one must think about how it happens. In other words, the actions that take place to cause something to become true. To do this, you first need to add up all of your assets. Next, add up all of your debts. Now subtract your total debts from your total assets. If your total debts are more than your total assets then you are technically already broke, but your paychecks keep the sinking ship afloat for the time being.

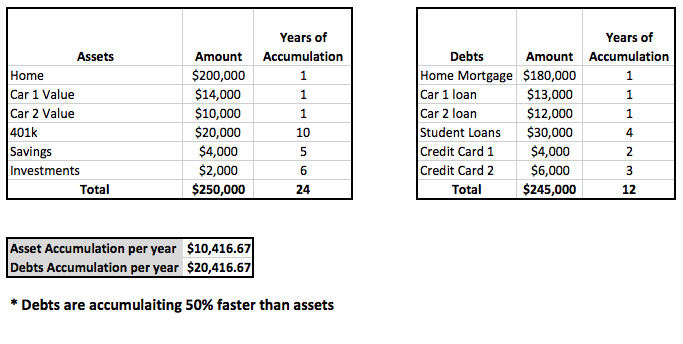

If you have more assets than debts you are at least above water. We now need to figure out if your debts are growing faster than your assets. To do this relatively quickly, figure out how long it has taken you to accumulate your assets. Then do that same for your debts. If you notice it took you 20 years to acquire your assets and only 5 years to accumulate your debts. You are unfortunately heading down the path to going broke. To figure out your average rate of accumulation for each category, divide total debts by the total year and then do the same for your assets. You can then combine these numbers to create a ratio that explains how fast you are accumulating in each category per year on average. Please see that chart below for an example.

In the example listed above, this person or family is on a path to going broke. They are accumulating debt two times faster than assets. This is not a good thing and it is the exact opposite of what you want to do financially. There is some good news. You can course correct this and still obtain your financial goals. Here are some tips.

- Develop some goals that are specific and measurable.

- Create a budget.

- Decrease your consumption.

Wise Pace specializes in helping you to become the master of your finances. Reach out to us for help. We got your back.