The reality is, debt makes everything more expensive. Let's use credit cards as an example. Credit card companies are willing to give you rewards for using their products for many reasons. For starters, they collect a fee every time a transaction is made with their card. The retailer or merchant has to pay the agreed upon amount to the credit card companies. Fee structures vary and could be a percentage per swipe or a specific amount based on monthly transactions. Square charges 2.75% per transaction. So where do you think this cost gets passed on to? It gets passed on to us. To add even more to this, credit card companies are betting that the average person does not pay off their entire balance. When this happens they receive an additional stream of income in the form of interest, the current average is 15.07% APR. But wait there is more. Please refer to the pictures below of Bank of America's Visa points model which was taken from my account after logging in.

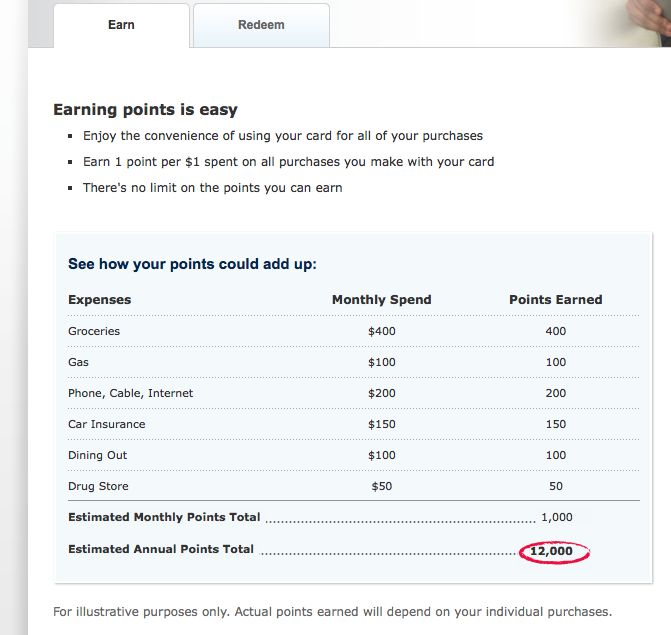

At first glance, 12,000 points make me really excited. My brain instantly associates 12,000 into $12,000. This is exactly what the marketers want you to think. Please see the next picture below.

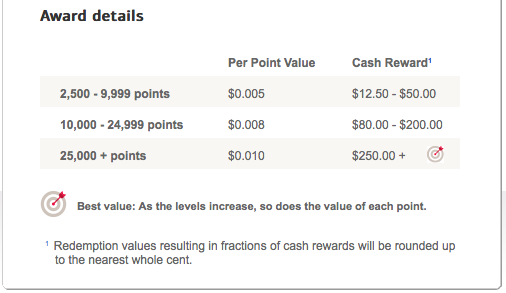

What do you notice on this screen? $0.008 per point. This does not even make me want to get up in the morning. If someone told me that they would give me $0.008 off for every dollar I spent laughter would be an appropriate response. Why? Because it is not worth it. If $100 was spent I would receive $0.80 back worth of value in points. There is not much that you could buy these days with $0.80.

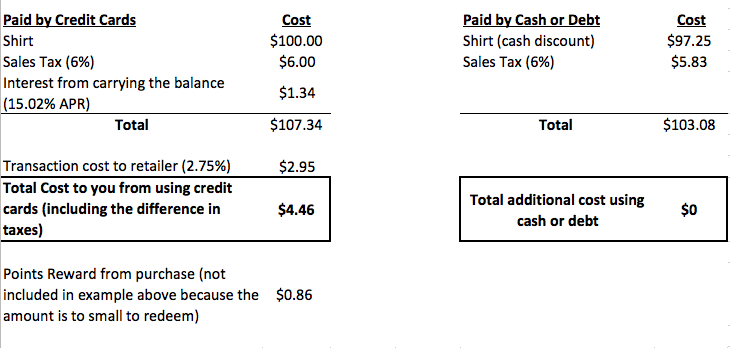

Let's look at the impact that credit card fees are having on what you pay. Say you purchase a shirt for $100, plus a 6% sales taxes, and do not pay it off at the end of the month. Your total cost will be $106.00 for the shirt but the value of the shirt is really only $97.25 (factoring in the 2.75% transaction fee charged to the retailer). This means you overpaid by $4.46. Now I know most of you are rolling your heads saying who cares about $4.46. Well if you paid for everything on your credit card like Bank of America's model, the 1st picture above ($1,000/mo or $12,000/year), your total additional cost for the month is $44.60 ($1,000/$100 = 10 * $4.46) . That amount of savings would pay all but $2 worth of my monthly cell phone bill. Does that not excite you? How about $535.20 per year in savings? That could almost pay for a cruise for one person. Oh sorry, I forgot to redeem my points which equal $96 (12,000 points * $0.008) for the whole year. Bottom line it is not worth it. Do not be a fool and fall into their trap. Below is the math behind all of this.

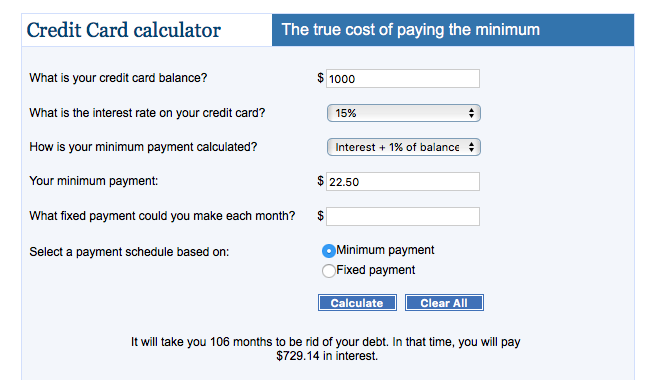

Here are a two more examples. First, look at the picture below from Bankrate showing the cost and how long it would take to pay off $1,000 of credit card debt only making the monthly minimums. If you want to play with their calculator to adjust for your cards settings, just click on the picture. Second, click on the hyperlink of PBS to watch a quick video that they did on credit cards.

I know this is a lot and it might be hurting your head. Here are two simple tips. Pay off your credit card balances every month and always ask for a cash discount. Cash discounts are often times available. If not, they will offer a different discount mainly because you asked. My wife and I have saved a lot of money doing this and you will be surprised by how much you could save by doing the same thing.