Debt has become a very comfortable thing in our life. It is very easy for us to borrow money to purchase anything. My mailbox receives offers to open up a new credit multiple times a week. Why has debt become so comfortable to us? Is it the free points or miles? Maybe the convenience of paying for something without having to worry if a certain checking account has the money to cover it? Could it be because we can buy something instantly and then pay it off over time in bite size chunks? I believe the answer is all of the above.

It feels great to be able to buy something whenever I want it. The freedom to go anywhere or to buy anything using someone else's money just sounds brilliant. On top of that, I feel successful because of everything I have bought and done. The reality is that it is an illusion. It is like a magician making a rabbit disappear in front of our eyes. If debt is used to buy something it means I do not have enough money to purchase it. As soon as I make the decision to borrow, aka debt, I instantly owe something to someone. This means that they now have power over me until the debt is paid in full. This power is in the form of interest. I now have a new reality of someone having power over me because I have to return more than I borrowed. This sure sounds like a lot of work. It sounds that way because it is. Borrowing something small like $100 is not a big deal, but what about $200,000? Yes, that is a huge deal. For some reason, this has become not so big of a deal. One form of this is a house mortgage.

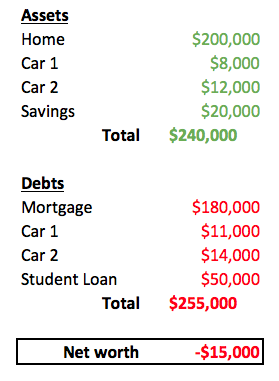

I will try to paint a simple picture of what this all means. The following is a hypothetical family, but very typical.

The Jones have the following for their family of two. A 30-year fixed-rate mortgage on a house for $180,000. The house is worth $200,000. Two car loans. One car loan with a balance of $11,000 and worth $8,000. The second with a balance of $14,000 and worth $12,000. Mrs. Jones was in the military and she went to college with the G.I Bill. She was able to get a degree without student loans. Mr. Jones obtained a degree that he paid for with student loans in the amount of $50,000. Thanks to Mrs. Jones, they are aggressive savers and have managed to save $20,000. They continue to make the monthly minimums and continue to save. Life is perfect. Well is it? Not quite. They sure have a lot of great things and they are making ends meet but their net worth is negative $15,000. Below is the math:

The truth is most Americans do not have $20,000 in savings. According to a CNN Money article, 76% of Americans are living paycheck to paycheck. This would bring the Jones' net worth down to negative $35,000. What does a negative net worth mean? It means you have nothing in your name because everything you have is technically owed to someone else. If you continue to make your payments on time the "someone" else will not come banging on your door looking for what is owed to them. As soon as a couple payments are missed they start to knock on your door. As soon as they become tired of knocking your "assets" will be taken away. Don't skim past this and think it will never happen to you. All it takes for you to not make the payments is for you to lose a job, become disabled, or a major death in the family to only name a few. The truth is any one of these could happen to us and one most likely will. There is no way to prevent it from happening. Millions lost their jobs in the great recession.

Bottom line, do not build your house on a foundation of cards. If one card at the bottom falls, the whole house will come crashing down. Debt is a tool that should not be used regularly. If you do decide to go into debt, make sure you weigh all of the costs. Build a foundation of concrete and not of cards.

If you are in the situation listed above, contact us for help. Wise Pace will help you to turn this sinking ship around. If you do not reach out to us, please reach out to someone. A financially healthy you will help you reach your goals and it contributes to creating a financially healthy nation.