Why is our cost of living so high? It is so difficult to work 5 days a week for money that is just used to pay the bills. Rent in Atlanta, GA can range from $800 to $1500 a month, more or less. That is a huge chunk of money from our paycheck. We have not even mentioned utilities and food. There are some ways that you can alleviate this burden. Are you single? Perfect, because you have a lot of opportunities. I am going to share some tips that can help you set up for success with your finances.

Live with roommates. Roommates equal a less expensive life. Now we all have different tolerances with people. It is important to self-reflect about how many roommates you could successfully live with. For those of you who say "I do not want to live with a roommate", continue reading before you completely write off the idea. Living with roommates have a ton of benefits beyond financial. For one, if you plan to marry one day, roommates help to teach us how to live with others. This is perfect because a spouse is a roommate you just happen to live more intimately with.

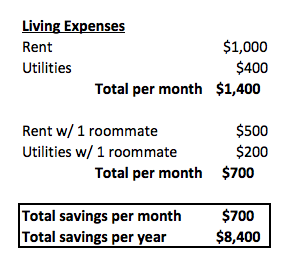

Second, they help share your costs of living. One roommate instantly cuts your expenses in half. Your $1,000 rent per month just went to $500 per month. All of your utilities (cable, internet, electricity, etc.) also instantly cut in half. Utility bills can easily equal $400 per month and you are now saving an additional $200 per month. This brings us to $700 per month in savings by just living with a roommate. Saving $700 per month equals $8,400 per year. Do you have a dream of owning a home one day? This amount of yearly savings could have you in a home within 4 years. You would have the ability to purchase a home worth $150,000 putting 20% down on a 15 year fixed-rate mortgage. This brings me to my next tip.

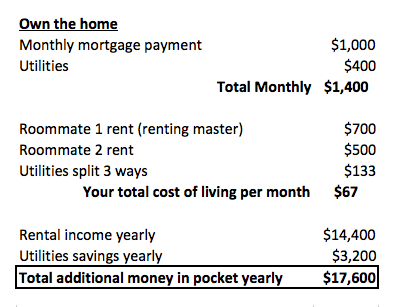

Own a home? Awesome, rent out the rooms. Your roommates have become tenants and this is fantastic when done right. Let's say your $1,000 of rent per month has turned into your mortgage payment. The house you bought has 3 rooms and 2 baths. You could rent each room for $500 a piece and live in your own home for free because someone else is paying the mortgage. By renting out the master, you could also make an additional $200 per month extra. Of course, this means you would be living in a smaller room and sharing a bathroom, but for $2,400 of yearly savings it can be worth it. In this model, you would make an additional $14,400 of income per year with renting out the master. Factor in your savings on utilities with two roommates which is $3,200. A grand total of $17,200 of additional money is in your pocket every year. If you are thinking about this model of buying a home reach out to us at Wise Pace. We can help you decide if it is a smart decision to buy or wait for a better time.

The married couple is probably asking by now, how does this help me. Well, if you are a newly married couple trying to save up for a home. Living with roommates can be a great way to save up cash faster. I would recommend trying to live with an older couple that is renting their in-law suite or something similar. The reason for this is because most likely they will not be trying to spend a lot of time with you and the relationship will be more of a business transaction. You do not want people prying into your personal lives while you are trying to build a new life with a spouse.

Bottom line is to live as smart as possible while you are single or just starting out in marriage. It only gets more expensive from there. Roommates are a great opportunity to teach us about living well with others while also supplying financial benefits.