Have you ever heard someone say, "don't worry about mortgage interest because the rates are so low and the interest is tax deductible"? I know I have. This advice is not terrible advice given that interest on a mortgage is quite substantial and the tax deduction can easily reach $2,000 per year. What typically comes next is "you should invest the money and receive greater returns while experiencing compound interest". It is possible to experience greater returns by investing your money. The power of compounding interest is very powerful and should be utilized. Take a look at the following examples to help you decide for yourself.

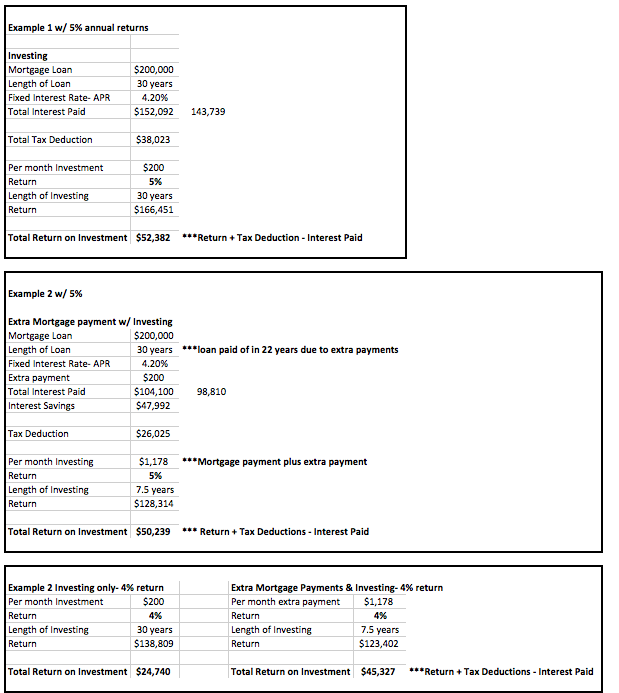

Example 1: Let's say you have a 30 year fixed mortgage balance of $200,000 at 4.2% APR and that you have an extra $200 per month that you are trying to figure out what to do with. If you take the advice previously mentioned and invested the money with a 5% annual return, in 30 years you could have $166,451 in that account. Total interest paid on your home would be $152,092. Don't forget your mortgage interest tax deduction! At a 25% marginal tax rate, your total deductions would be $38,023. Total return is $52,382 ($166,451 return + $38,023 total tax deductions - $152,092 interest paid). Not bad! The problem with this scenario is it does not factor in risk.

The previous example assumes that you will receive an annual return of 5% per year for 30 years. A guaranteed rate in stocks is just not realistic. It is possible to have higher returns and also equally possible to have lower. Average U.S stock market returns throughout history are around 10%. Of course, this would be your return if you invested in 1928 and held it until today. Timing is everything and it will drastically change the returns. Investing in the 1990s will not yield the same returns as in the 2000s. Every year and decade are different. Just FYI, the average investor only returns 3.7%. Ultimately, there is no guarantee of your return. But guess what is a guarantee? Your fixed mortgage interest.

Example 2: If we use the additional $200 per month to pay off the mortgage, the total return will be $50,239. You will also be able to invest more when the mortgage is paid off because you now have the payment to add to it. This return is $2,143 less than example one. But wait there is more. Remember how I said there is no guarantee of returns in the stock market? Say your annual return was only 4% instead of 5%. Paying off your house early would bring a total return of $45,327 vs. $24,740 of just investing over 30 years. Extra payments on your mortgage have now brought an extra $20,587 versus the just investing plan. All of this happened with only a 1% decrease in returns.

Key takeaways. Tax deductions are great but you often times spend more than you save. Use them, but don't abuse them. Debts ability to help you could come down to only a 1% difference. Would you want to bet your house on that small of a margin? Build a house made of brick and not of cards. Taking risks can be good, but it is best to take WISE calculated risks. Reach out to us if you would like some help.

Below are some tables to help you visualize the math.